Tax season is upon us! Make sure you’re getting everything right with these step-by-step instructions on how to update your tax and payment details in the SymphonicMS. We’ve got everything you need to know right here. Let’s dive in…

How To Update Your Tax and Payment Details with Symphonic

Step 1:

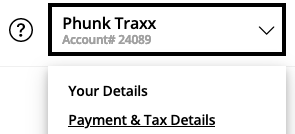

Log on to SymphonicMS.

On the top-right menu, click on the account name and then select Payment & Tax Details.

Step 2:

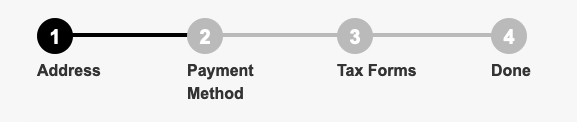

Next, you will see a navigation window that shows you each step that needs to be filled out.

Step 3:

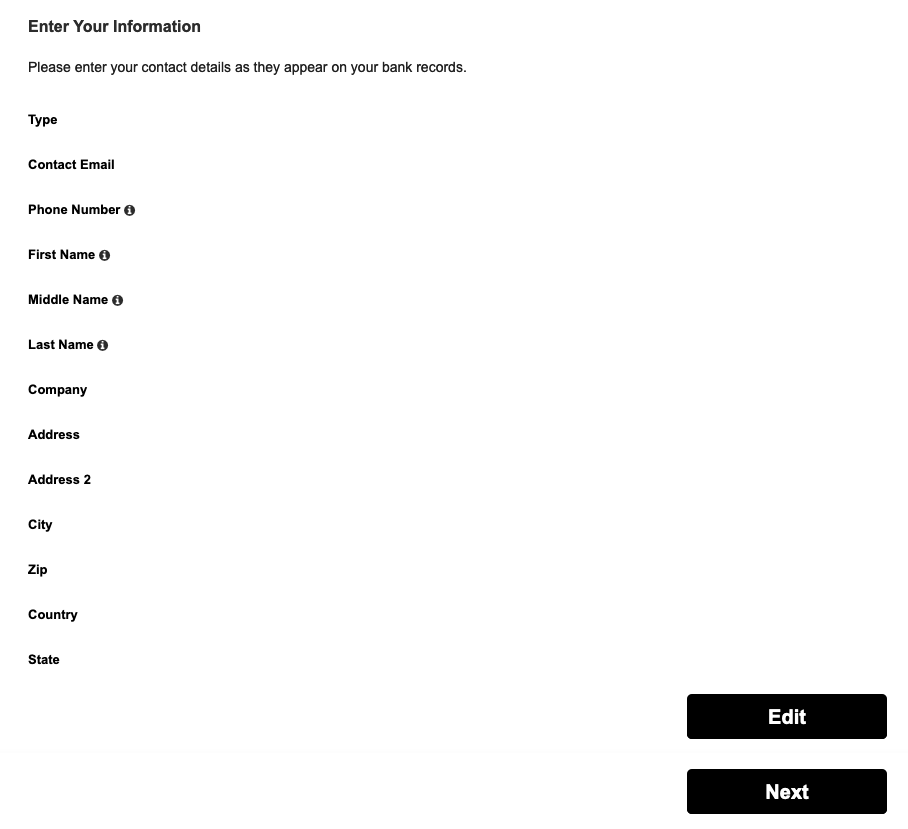

Enter your address details as shown below:

Step 4:

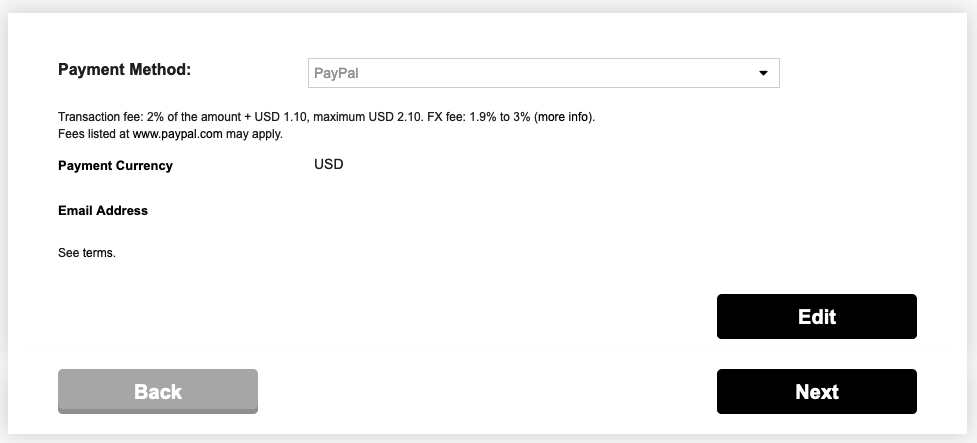

After that, you will choose your desired payment option depending on your territory.

After that, you will be transferred to a screen where you can enter your Payment and Tax Details. When you arrive at the tax forms, you will choose a tax form based on your situation. You can also get assistance by filling out a questionnaire right inside the system.

For quick reference:

W-8BEN = International (outside of the US) individuals

W-8BEN-E = International (outside of the US) companies/entities

W-9 = Domestic (US) individuals/companies/entities

Step 5:

After you enter the information, the next screen will ask a few tax-related questions that are very important.

The initial section of the Identification of Beneficial Owner (Part I) asks you for your name, address, and basic information.

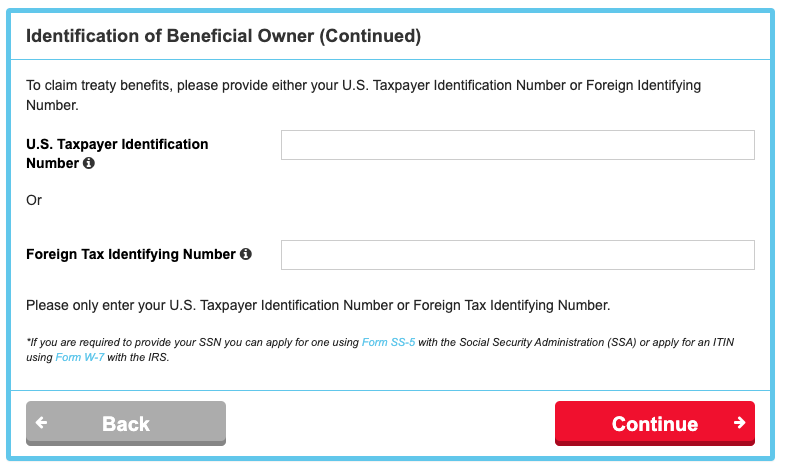

For the Identification of Beneficial Owner (Continued) section, International clients (living outside of the United States) should fill out the Foreign Tax Identifying Number. This is your passport, Driver’s license, National ID, etc. from your country of residence. This is NOT a US number. If you have a U.S. Taxpayer Identification Number, then please go back and fill out a W-9 form.

In the next section, it is very, VERY important that you enter the country you reside in. This will ensure that our system does not unnecessarily apply 30% tax withholding if you are in a country with a lower rate already negotiated with the U.S. government. Do not click “Continue” here on this next screen; please ensure you enter this correctly!

- If your country of residence is not on the list, please leave this blank. This means the United States does not have a treaty in place with your country.

- NOTE: Tax withholding is only applied to the USA territory. If your streams on Spotify come from Brazil, there is no withholding on that, only if you are in a country where there is a withholding percentage for USA-sourced income. The withholding is minor in many cases — more on this available here.

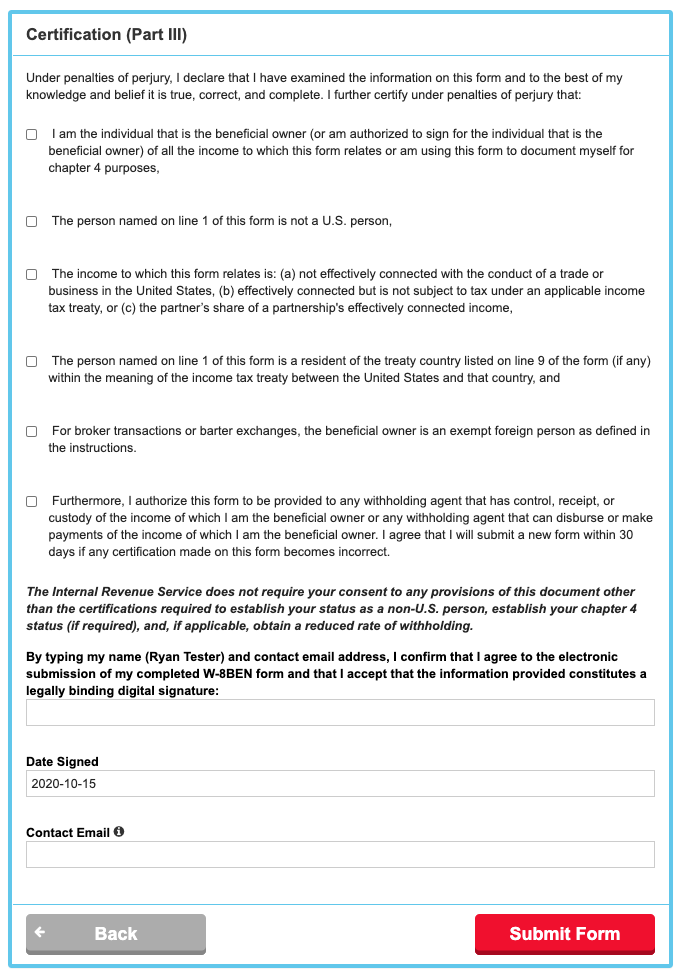

Step 6:

After the “Review” screen, you will be asked to do one last bit of Certification (Part III). This is standard double-checking to ensure that everything is in compliance with regulations. Once you select each box, you will be able to proceed.

Next, you will then provide a basic explanation for any non-US address. You can state: “I am a client of Symphonic Distribution, residing outside of the United States and Symphonic distributes my music.”.

You can also supply either a Passport, Driver’s License, or National ID, which will be stored securely to validate payment(s).

After you complete these steps, you are good to go! 👏

If you have any questions or are stuck on anything, the questionnaire at the beginning will assist you as shown below:

International Withholding Questions

- We’ve prepped this in-depth resource about international tax-related questions.

Payment Related Questions

- For questions regarding requests of payments, how long they take, etc… please click here.

Do I ever have to update my tax details again?

- No, not if you don’t move or if your tax status does not change. However, for all territories, we suggest you verify your tax details via the system at least once per year to ensure accuracy.

Do I have to send any tax forms to you in addition to this?

- No! Once you have completed this process, you are done.

——

🤔 Any additional questions?

No problem. Submit a request here.